Learn More About Housing and Finances Around Evansville, IN

Help us break down barriers to homeownership in Evansville, IN! Streamline our intake process while taking the first step to launch your housing counseling career. Position Description: The Housing Counseling Intake Specialist will serve with HOPE of Evansville in Evansville, IN from August 2025-2026. HOPE of Evansville (HOPE) is part of the Housing Counseling Corps initiative of Housing Action Corps, an AmeriCorps VISTA program managed by Housing Action Illinois since 2010. Housing Counseling Corps members receive custom training, support, networking, and post-service employment opportunities in the housing counseling field, in addition to the traditional benefits of AmeriCorps VISTA. Learn more: housingactionil.org/americorps. HOPE of Evansville provides, promotes, and sustains affordable housing and credit counseling opportunities for low-to-moderate income families. HOPE operates three key affordable housing programs: foreclosure prevention, down payment assistance, and housing development. The Housing Counseling Intake Specialist will streamline our intake system and implement a communication system to engage clients from application to appointment. They will also work on grassroots outreach and marketing projects to help households learn about HOPE’s programs and identify potential pre-purchase clients to work towards homeownership. We are looking for candidates with a long-term interest in housing counseling or social services. They should be comfortable talking to community members and stakeholders, as well as demonstrate patience when helping clients. Willingness to learn about and improve our systems is a must! Member Duties HOPE is dedicated to working with low-to-moderate income households to break down barriers to homeownership. With rising demand for housing counseling services in Evansville, HOPE needs a dedicated VISTA to streamline our intake process to make our programs more accessible to the community and conduct outreach to ensure everyone who needs assistance is aware of our services. The Housing Counseling Intake Specialist will collect staff feedback, research best practices, and implement a centralized intake program to maximize the effectiveness and efficiency of our services. During service, they will also study for and take the HUD housing counseling certification exam to become a HUD certified housing counselor. To increase the reach of HOPE’s housing counseling programs, the VISTA will create a marketing and outreach campaign that includes attending networking meetings and outreach events. Additional Position Information: Service Address: 900 N Main St Evansville, IN 47711-5054 Supplemental Benefits: Yes, TBD Languages: N/A Field of Service : Community Outreach, Housing, Neighborhood Revitalization Skills: Communications, Counseling, Social Services Car Recommended: No

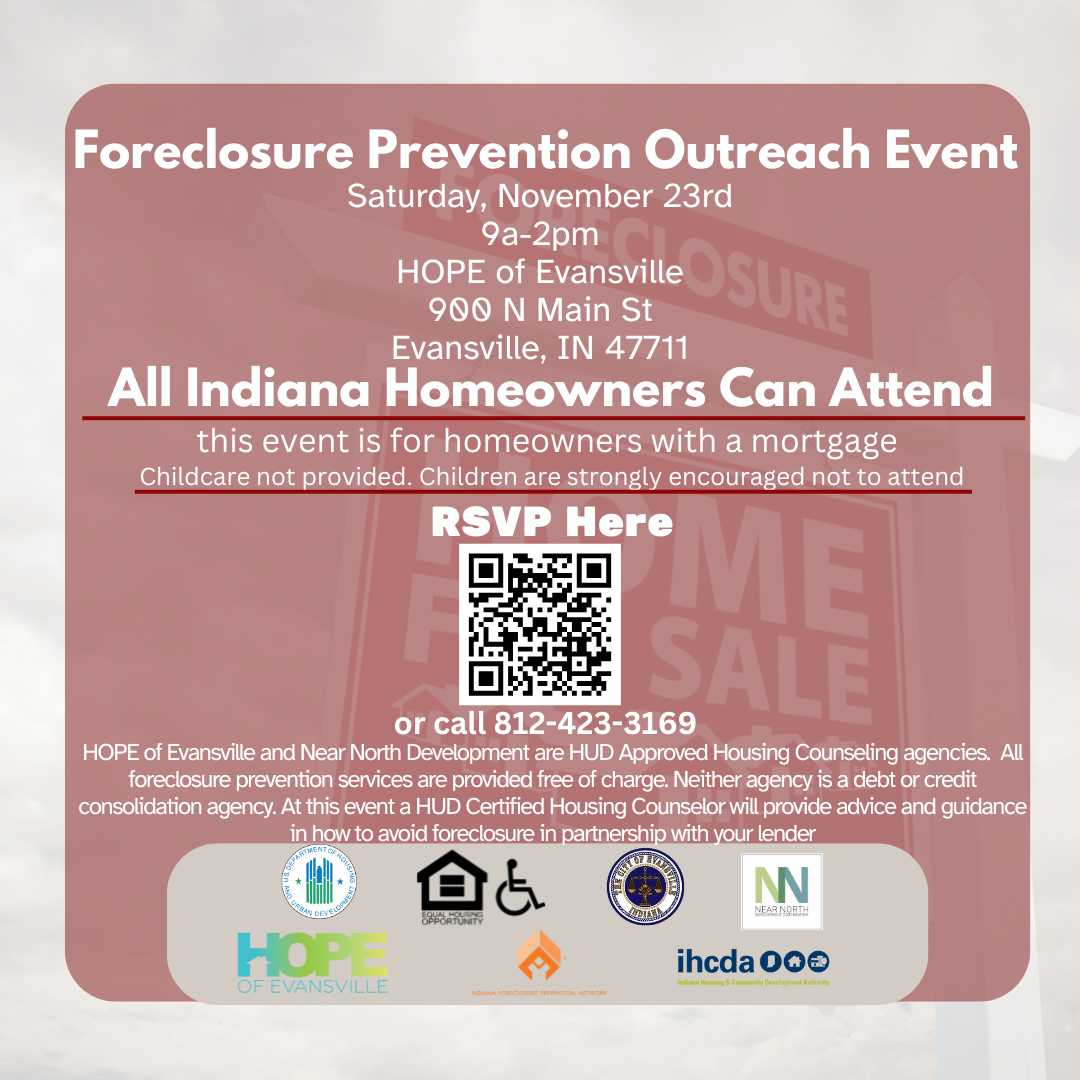

Homeowners in Indiana facing financial hardships and struggling to keep up with mortgage payments are invited to attend a free foreclosure prevention education event on Saturday, November 23, from 9:00 AM to 3:00 PM. This event is being provided in partnership with HOPE of Evansville and Near North Development Corporation, both HUD Certified Housing Counseling Agencies. This event is designed to provide critical resources and strategies to help homeowners navigate financial challenges and work with their lenders to avoid foreclosure. The event offers one-hour time slots to ensure personalized support for every attendee. Participants will gain: • Expert advice on how to communicate effectively with lenders. • Guidance on available assistance programs. • Tools to develop a plan for financial recovery. "Our goal is to empower homeowners with the knowledge and resources they need to address their mortgage challenges and avoid foreclosure," said Tehiji Crenshaw, Housing Counselor from Near North Development Corporation. "We want to ensure families can remain in their homes while finding practical solutions to financial hardships." A representative from Pigeon Township will also be at this event providing information on how to receive information & assistance from the Trustee’s Office for those experiencing a financial hardship. How to Participate RSVPs are encouraged to reserve your one-hour session, but walk-ins are welcome. To sign up, visit this jotform o register or contact us at 812-423-3169. This event is open to Indiana homeowners of all backgrounds who are experiencing difficulty with their mortgage payments. Don’t miss this opportunity to take the first step toward financial stability and peace of mind.

HomeBoost is back for another year through FHLBank Indianapolis. HomeBoost may provide grants of up to $25,000 per household to assist with down payments and closing and counseling costs for income-qualified, eligible first-time homebuyers looking to purchase a primary residence in Indiana or Michigan. The HomeBoost Down Payment Assistance Program provides down payment assistance grant funding to prospective first-time homeowners who: -identify as Black or African American, Asian, Hispanic, Indian American or Alaska Native, and/or Native Hawaiian or Other Pacific Islander; or -identify as a first-generation homebuyer and meet at least one of the outlined criteria for first-generation homebuyers: -The parents or legal guardians of at least one borrower do not currently and have not previously owned a home in the United States, or -At least one borrower has aged out of foster care, or -At least one borrower has become emancipated. Eligible households must have a total household income at or below 120% of the local Area Median Income as defined by HUD and must intend to purchase a primary residence in Indiana or Michigan. Eligible households who wish to use HomeBoost funds must work with a participating Federal Home Loan Bank of Indianapolis member financial institution to submit a request. For more information, visit: https://www.fhlbi.com/services/community-programs/homeownership-initiatives/homeboost-down-payment-assistance-program/

In case you missed the announcement, Evansville Water and Sewer Utility (EWSU) customers who qualify for bill assistance now have two options to save on their water bill: Chose to receive up to $1,000 in plumbing repairs or updates made by a certified professional through the Leak Repair Program or a $30 monthly credit on their EWSU bill through the Bill Relief Program. The Leak Repair Program option is designed to reduce water usage and save more money over time. Starting TODAY, customers may sign up for the new Leak Repair Program and receive up to $1,000 in small repairs to their home water system, including a water-efficient toilet or plumbing fixtures. Or, they can choose the Bill Relief Credit, which will triple, from $10 a month to $30 a month. That means City residential water customers who have active water service and are income-eligible to receive the credit will save up to $360 a year on their water bill. Customers already receiving the Bill Relief credit have until the end of August to switch to the Leak Repair Program. To learn more, visit ewsu.com/CustomerSupport. Who’s Eligible To participate in the Leak Repair Program, EWSU City residential customers must have active water service and a household income that qualified as low-income based on HUD federal guidelines. To be eligible for the Bill Relief Program, City residential customers with active water service must have a combined annual household income of $50,000 or less. How The Program Works To apply for the Leak Repair Program, visit ewsu.com/leakrepair to fill out and submit an application form. EWSU will email you to confirm the application was received and will forward the application to Memorial Community Development Corporation (MCDC) to review your financial status and coordinate a home visit assessment with a plumbing contractor through MCDC’s emergency repair program. If needed repairs exceed the money allotted, MCDC will refer customers to other agency repair programs in the community. Customers must meet the requirements of each agency. To apply for the Bill Relief Program, visit ewsu.com/billrelief to fill out and submit an application form. EWSU will email you to confirm the application was received and whether your request was approved or denied. Funding for The Program In 2022, the City of Evansville allotted $4 million in federal funds from the American Rescue Plan, received during the Covid-19 pandemic to provide direct relief to income-qualified EWSU customers to lighten the cost of their utility bill. The Leak Repair and Bill Relief programs leverage this funding and will be offered through the end of 2026 or until funding is depleted. Approximately 3,000 applications have been received since the Bill Relief Program launched in 2022; however, EWSU estimates more than 20,000 households could qualify for aid. To learn more, visit ewsu.com/CustomerSupport. This information came from the Press Release distributed by EWSU on July 15.

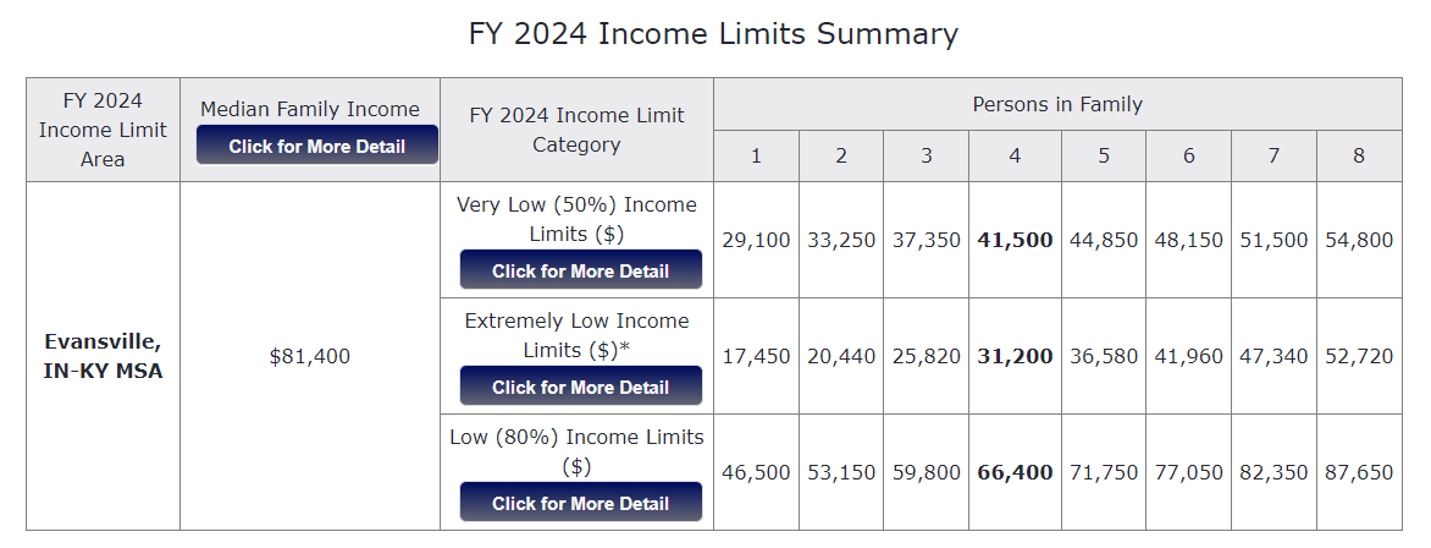

HOPE of Evansville is pleased to announce the receipt of a generous $10,000 grant from the State Farm Foundation. This significant contribution will support HOPE's Neighborhood Revitalization initiative, specifically through the enhancement of Housing Counseling Services, aimed at fostering stronger, more vibrant communities. For many years, the State Farm Foundation has been a steadfast supporter of HOPE of Evansville, providing both financial assistance and volunteer services. This long-standing partnership has been instrumental in empowering residents through various housing programs and community revitalization efforts. Josh Calhoun, Executive Director of HOPE of Evansville, expres sed his heartfelt gratitude for the continued support from the State Farm Foundation. "We are incredibly thankful for the State Farm Foundation's unwavering commitment to our mission. Their support over the years has enabled us to make a tangible difference in the lives of many families. This latest grant will further our efforts in neighborhood revitalization and help us provide crucial housing counseling services to those in need." HOPE provides up to $15,000 in down payment assistance to first time homebuyers who qualify and receive housing counseling services. This program is helps low-moderate income homebuyers be competitive in the current housing market. The funds received from this grant will directly support HOPE’s housing counseling services and housing development initiatives in the city of Evansville. “All of our clients receiving down payment assistance are under 80% of the Area Median Income, which is just over $66,000 for a family of four, and most are first-generation homebuyers,” said Calhoun. “The pre-purchase program offered through HOPE is able to completely shift a family’s financial future, that’s why these programs are so critical to our community, especially now.” The $10,000 grant will be utilized to expand HOPE's Housing Counseling Services, offering personalized guidance and support to residents as they navigate the complexities of homeownership, foreclosure prevention, and financial stability. These services are a cornerstone of HOPE's mission to build sustainable communities where everyone has the opportunity to thrive. Last year, HOPE provided over $146,000 in Down Payment Assistance enabling $3.4 Million in home purchases within the city of Evansville; successfully prevented foreclosure for 2,230 households throughout the state of Indiana; secured 1.5 Million from the Affordable Housing Trust Fund for low-income seniors; and began rehabilitation on three buildings in the Jacobsville Neighborhood. State Farm Foundation's continued investment in HOPE of Evansville underscores its dedication to community development and support for local initiatives that drive positive change. By working together, both organizations are paving the way for a brighter future for Evansville's neighborhoods.

To qualify for HOPE’s Down Payment Assistance (DPA) program you must be below 80% AMI for Vanderburgh County. These income limits change every year, and 2024 income limits have just been released. The row labeled “Low (80%) Income Limits ($)” is the maximum income you can have to qualify for DPA based on your family size. Family size is outlined across the top of the chart. For example, if you are single (1 person on the mortgage) and have one dependent and your gross income is below $53,150, you could qualify for DPA. Gross income is your income before taxes are taken out. What counts as income? Guaranteed hours at your job, this does not include overtime paid. Child support if it is court ordered and received. Counselors will use a receipt of the last 365 days received child support. Social Security/SSI/SSDI, pension, retirement income, dividends, etc. Section 8, TANF, or SNAP benefits do not count as income. This is not an exhaustive list, our counselor can speak more directly to your situation. Ready to see if you qualify? Join us for Fair Shot to get started. Starting through Fair Shot will waive the $35 application fee.

To qualify for HOPE’s Down Payment Assistance (DPA) program you must be below 80% AMI for Vanderburgh County. These income limits change every year, and 2023 income limits have just been released.

The row labeled “Low (80%) Income Limits ($)” is the maximum income you can have to qualify for DPA based on your family size. Family size is outlined across the top of the chart. For example, if you are single (1 person on the mortgage) and have one dependent and your gross income is below $55,900, you could qualify for DPA.Gross income is your income before taxes are taken out. What counts as income? Guaranteed hours at your job, this does not include overtime paid.Child support if it is court ordered and received. Counselors will use a receipt of the last 365 days received child support. Social Security/SSI/SSDI, pension, retirement income, dividends, etc.Section 8, TANF, or SNAP benefits do not count as income.This is not an exhaustive list, our counselor can speak more directly to your situation.Ready to see if you qualify? Join us for Fair Shot to get started. Starting through Fair Shot will waive the $35 application fee.

To qualify for HOPE’s Down Payment Assistance (DPA) program you must be below 80% AMI for Vanderburgh County. These income limits change every year, and 2022 income limits have just been released.

The row labeled “Low (80%) Income Limits ($)” is the maximum income you can have to qualify for DPA based on your family size. Family size is outlined across the top of the chart. For example, if you are single (1 person on the mortgage) and have one dependent and your gross income is below $48,750, you could qualify for DPA.Gross income is your income before taxes are taken out. What counts as income? Guaranteed hours at your job, this does not include overtime paid.Child support if it is court ordered and received. Counselors will use a receipt of the last 365 days received child support. Social Security/SSI/SSDI, pension, retirement income, dividends, etc.Section 8, TANF, or SNAP benefits do not count as income.This is not an exhaustive list, our counselor can speak more directly to your situation.Ready to see if you qualify? Join us for Fair Shot to get started. Starting through Fair Shot will waive the $35 application fee.

Thanks to a generous grant from CenterPoint Energy Foundation, HOPE is able to provide financial assistance for rent, mortgage, water utility, or debt reduction. With this program, HOPE will also provide budget counseling and participants will have the opportunity to move forward with credit counseling as well. CenterPoint Energy’s charitable foundation is funded by shareholders and has no impact on customer rates. The Foundation's finances are independent and separate from the company and may not be used directly toward energy assistance.This assistance is available to people under 80% AMI (see if you qualify here) and are CenterPoint customers.

This application is currently closed. Follow us on Facebook for updates on when it will open again.

The 2022 Raise the Roof E-Mail Campaign is here to help you achieve your

goals in 2022.